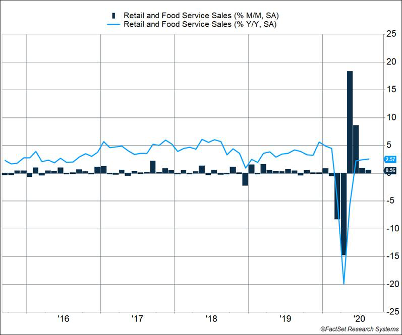

Retail sales figures continued a string of economic data pointing toward slowing growth accompanied by a gradual reopening of state economies. Consumers seem willing to take some risks. Retail and food service sales rose 0.6% last month. (See Chart 1.) Increased sales at restaurants contributed most to the monthly gains.

Key Points for the Week

- Retail and food service sales rose 0.6% last month. A rebound in purchases at restaurants accounted for most of the increase.

- Stocks edged lower last week as the S&P 500 dropped 0.6% and is now off 7.2% from the Sept. 2 high.

- Most Federal Reserve officials expect to leave interest rates barely above zero until 2024.

The Federal Reserve had its first meeting since sharing its new approach to balancing inflation and employment when setting policy. The Fed reaffirmed its intention to let inflation move higher than 2% to make up for low inflation in recent years. Fed officials expect interest rates to stay near 0% until at least the end of 2023.

Stocks continue to struggle in the current environment. The S&P 500 dipped 0.6% and is down 7.2% from its Sept. 2 high. The MSCI ACWI index rose 0.2% as global stocks gained ground on the strong-performing U.S. market. The Bloomberg BarCap U.S. Aggregate Bond Index dropped 0.1%.

Home sales and durable goods will headline a relatively light week of economic data. Durable goods and other business data will provide some clarity on how businesses are coping with the remaining challenges. Political risk calculations have become more complex with the passing of Ruth Bader Ginsburg.

Figure 1

Diminishing Returns

In economics, the law of diminishing returns states that as one input in a production process is increased, while the rest are held steady, the increased output will diminish as the one factor gets out of balance with the overall production process.

The current economic and market environment is undergoing its own experience with diminishing returns. After surging in May and June, retail and food service sales roles only 0.6% last month. The very normal monthly increase indicates the economy is not reclaiming the lost sales from March and April.

Increased dining purchases were the only real bright spot in the report. Sales at restaurants and bars rose 4.7% last month, although they are still 15.4% lower than last year. Clothing sales are more than 20% lower than last year, and gasoline purchases remain lackluster, too. The period of rapid recovery has been replaced with a slow trudge as COVID-19 restrains consumers.

The market is reacting to the news of slowing growth mixed with the consumer’s reticence to venture out as states and cities reopen their economies. Since the market peaked on Sept. 2, hard-hit value stocks have outperformed growth stocks that have dominated in recent years.

The Fed’s meeting last week confirmed what has been generally suspected. Returns from low-risk investments are likely to remain lower for a while. In the Fed’s most recent rate projection, 13 of the 17 Fed members believe rates will stay between 0% and 0.25% through the end of 2023. Interestingly, two Fed voting members dissented. One, Neel Kashkari, simultaneously advocated for leaving rates lower and being humbler in their economic sentiments. Kashkari believes the Fed’s ability to estimate full employment is very limited and the Fed should use inflation to gauge whether rates are too low.

One advantage to this approach is the Fed faces the risk of diminishing returns when it is applied to interest rate cuts. Cuts when rates are high seem to benefit the economy more than when rates are already near zero. Negative rates haven’t created strong growth or robust inflation. Kashkari’s point is the Fed has ample tools to reduce inflation if it should pick up. What it lacks are tools to push inflation to normal levels.

The investing landscape seems to contain a few examples of diminishing returns. Retail sales are slowing as COVID-19 is holding back a stronger recovery. Returns have leveled off as growth stocks have lagged in recent weeks and interest rates are very low. In this environment, the Fed is wrestling with how to adjust its policy to maintain control of inflation while allowing it to drift higher. As we approach the fourth quarter, progress on each of these issues will likely be important if the market is expected to grind higher.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.britannica.com/topic/diminishing-returns

https://www.wsj.com/articles/fed-signals-interest-rates-to-stay-near-zero-through-2023-11600279214

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.minneapolisfed.org/article/2020/why-i-dissented

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20200916.pdf

Compliance Case # 00830839